What Is the Difference Between a Credit Union vs. Bank?

Banks and credit unions are different types of financial institutions that offer a wide range of services, from checking and savings accounts to fostering financial literacy through educational tools and programs. So, what’s the difference between a bank and a credit union? Keep reading to learn what credit unions and banks are, what they do and the differences between them.

What Is a Credit Union?

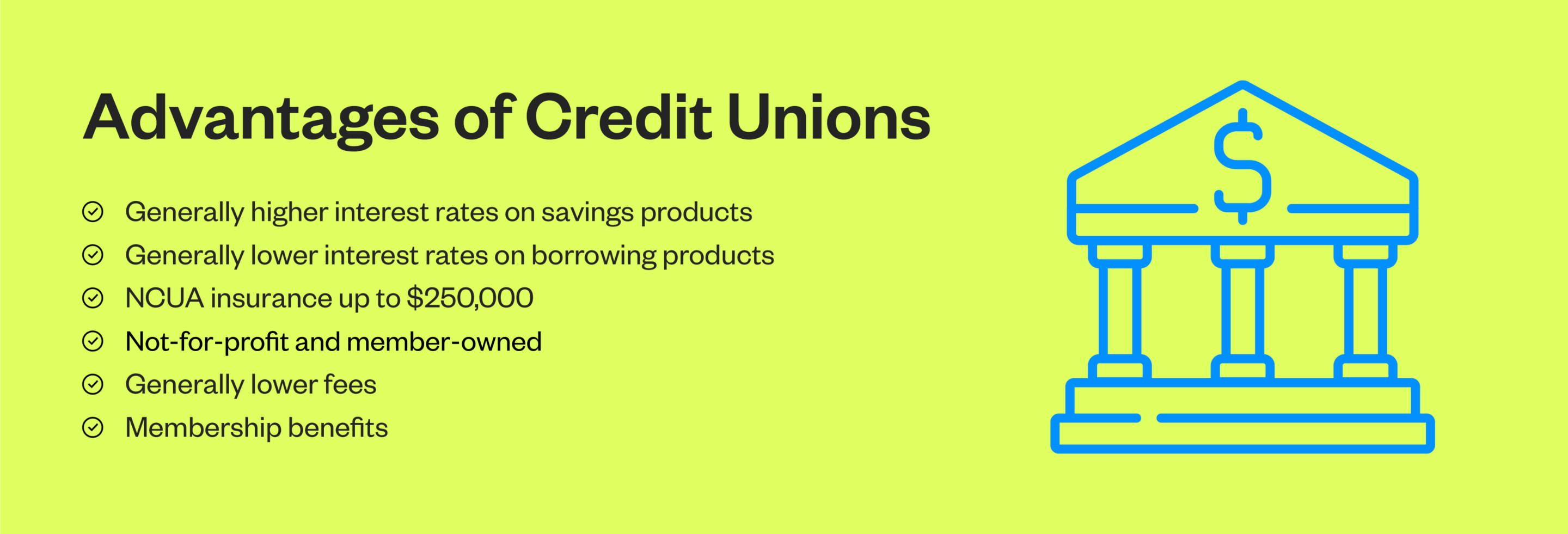

A credit union is a not-for-profit institution designed to serve its members. These financial institutions have a distinctive structure that results in various benefits for their members, ranging from favorable interest rates to tailored product offerings.

Ownership and Structure

Credit unions are democratic entities owned and operated by their members. This structure ensures that the institution operates with its members' best interests in mind instead of external shareholders. This philosophy is embedded in how these organizations function, aiming to return profits to members through improved services, better interest rates and fewer fees.

Interest Rates

Given our not-for-profit nature, credit unions can often afford to provide higher interest rates on savings products like savings accounts and share certificates. This means members can achieve faster growth on their deposited funds.

When it comes to borrowing and credit card offerings, credit unions typically extend loans at lower interest rates compared to conventional banks, making them more affordable for members.

Fees

While traditional banks operate to maximize profits for their shareholders, credit unions aim to serve their members rather than profit from them. Therefore, they often have fewer and lower fees. This could include reduced overdraft fees, lower account maintenance fees or even fee-free account options. The savings from these reduced fees can accumulate for members over time, providing substantial financial relief.

Product Offerings

Credit unions offer a comprehensive range of services, from basic checking and savings accounts to specialized business accounts. Their lending options are diverse, including personal loans, mortgages, auto loans, and commercial lending solutions. Additionally, many credit unions provide investment services such as wealth management and retirement savings accounts like IRAs. They emphasize member convenience through extensive digital banking solutions and widespread ATM and branch access. Furthermore, credit unions cater to both new and experienced investors with a variety of personal banking and investment products. They also offer financial counseling to help members with budgeting, investing, home savings, and retirement planning.

What is a Bank?

Banks are for-profit financial institutions licensed to accept deposits from individuals, extend loans and offer financial products and services. Unlike credit unions, banks are typically open to the general public and function to generate profits for shareholders and investors. Their primary revenue comes from the interest they earn on loans.

Ownership and Structure

Since banks are for-profit institutions, their operations, product pricing and services are geared toward generating revenue. Banks are generally open to the public, which means there aren’t the same membership requirements seen with credit unions.

Banks typically have a board of directors, executive management and various departmental managers and employees. The board oversees strategic direction, ensuring the bank adheres to regulatory guidelines while maximizing profits.

Interest Rates

Banks tend to offer slightly lower interest rates on savings products because they need to balance the interest they pay to depositors with the profits they generate for shareholders. Concerning borrowing, banks may have higher interest rates on loans and credit cards compared to credit unions. Various factors influence these rates, from the bank's operational costs to broader economic factors and the need to generate investor returns.

Fees

Banks often have a more extensive fee structure than other financial institutions because they aim to make money for their stakeholders. Common fees range from account maintenance fees, overdraft charges, ATM usage fees and specialized service fees. Competition drives banks to offer various accounts or services with reduced fees or fee waivers to attract and retain customers.

Product Offerings

Banks also provide everything from basic checking and savings accounts to specialized business accounts with a diverse lending spectrum encompassing personal loans, mortgages, auto loans and commercial lending solutions. Many banks also offer investment services, including wealth management, stock brokerage and retirement savings accounts like IRAs.

That’s not to say they offer more products than a credit union. Many credit unions offer these same products, including mortgages, personal loans and commercial lending solutions.

Should You Choose a Credit Union or Bank?

When comparing the difference between banks vs. credit unions to decide which one is right for you, consider your needs and goals. While both types of financial institutions offer financial services, their philosophies, structure and approach can differ significantly. Factors to consider when choosing between a bank vs. credit union include:

Membership Requirements

Joining a credit union might require living in a specific region or being part of a particular group. If you meet the eligibility criteria and want a more personalized approach, a credit union might be right for you. Conversely, banks cater to a broader audience, so they’re more accessible to just about anyone.

At California Credit Union, membership is open to any community members and businesses in Los Angeles, San Diego, Orange, Riverside, San Bernardino and Ventura counties, along with school employees throughout the state. You can also join if you have an immediate family/spouse/partner who is a California Credit Union member.

Interested in becoming a member? Learn more here.

Financial Situation and Needs

Consider your current financial situation and future goals. A credit union might be the better option if you’re looking for higher interest rates on savings or more affordable loan rates. On the other hand, if you want a vast array of products and investment options, you might prefer a bank.

Services Offered

While both banks and credit unions provide standard financial services, credit unions often excel in community-focused offerings and personalized member support. While both credit unions and larger banks will often offer diverse investment products and advanced digital platforms, credit unions will also emphasize educational resources and community engagement. For example, California Credit Union offers a suite of free calculators designed to help members understand banking basics and boost their financial confidence.

Fees and Interest Rates

Credit unions offer more favorable interest rates and fees because of their not-for-profit status. Banks are profit-driven, so they might offer lower interest on deposits but competitive rates on specific investment products or promotional offers. Choosing a credit union over a bank is a good option if you’re worried about overdrafts, late payments and account maintenance fees.

Accessibility and Convenience

If you prioritize accessibility, the expansive branch and ATM networks of larger banks can be beneficial, especially if you travel regularly or require international services. However, many credit unions are part of shared networks, offering access to services across various credit unions to expand their reach. For example, California Credit Union offers 85,000+ surcharge-free ATMs through the worldwide CO-OP® and Allpoint networks.

Community Engagement

Credit unions are community-focused and often engage in local events, sponsorship and community development initiatives. If supporting and being part of a community-centered financial institution resonates with you, you might choose to bank at a credit union. On the other hand, banks might engage in broader initiatives ranging from national to international partnerships.

This pillar is a huge part of our mission at California Credit Union, and we're very proud to support the communities we serve. Learn more about the ways we give back here.

Wrapping Up: What’s the Difference Between a Bank and a Credit Union?

Credit unions are member-centric and focus on serving specific communities and groups, often offering favorable interest rates and fewer fees. In contrast, banks are for-profit entities that cater to a broad audience with a wide range of financial products.

If you’re looking for a more personalized, community-based banking approach, explore California Credit Union's offerings. Member satisfaction and financial empowerment are the foundation of every service we offer, from personal to commercial banking and loans. Contact us today to become a member.