Mortgage Refinance: How to Refinance Your Mortgage

Refinancing your home loan is a significant decision with potential benefits and drawbacks. Whether you want to lower your monthly payments, get a better interest rate, change your mortgage loan term or use your home equity, understanding how refinancing works before applying is beneficial.

What Is a Mortgage Refinance?

Refinancing your mortgage replaces your existing loan with a new one. This new loan typically comes with different terms, such as a lower interest rate, different monthly payments or a changed loan duration.

Many people refinance their mortgages to get better interest rates. For instance, you can refinance to get a lower interest rate, which effectively reduces your monthly payments and how much you'll pay over the life of the loan. Others may refinance their homes to change the loan term, converting from a 30-year mortgage to a 15-year mortgage, which can result in paying off the loan faster and saving on interest payments in the long run.

Considering refinancing your mortgage? See how much your payments will be with our mortgage rate calculator.

How Does Mortgage Refinancing Work?

- Evaluate your current financial situation: Consider your credit score, income stability and debt-to-income ratio to determine if refinancing is a viable option for you

- Shop around for lenders: Look at interest rates, closing costs and loan terms to ensure you're getting the most favorable terms possible

- Submit an application: Be prepared to provide detailed information about your income, assets and debts, as well as documentation such as pay stubs, bank statements and tax returns.

- Appraisal and underwriting: An appraisal determines your home's current value, ensuring it aligns with the loan amount. Additionally, your application will undergo underwriting, where the lender assesses your financial situation and determines if you qualify for the refinance

- Receive loan estimate: After the lender reviews your application, they'll provide you with a loan estimate detailing the terms of the refinance, including the interest rate, closing costs and any other associated fees

- Lock in your rate: Once you're satisfied with the loan terms, you can choose to lock in your interest rate. This protects you from rate fluctuations while you complete the rest of the process

- Closing: Similar to when you initially purchased your home, refinancing involves a closing process where you sign the necessary paperwork to finalize the new loan

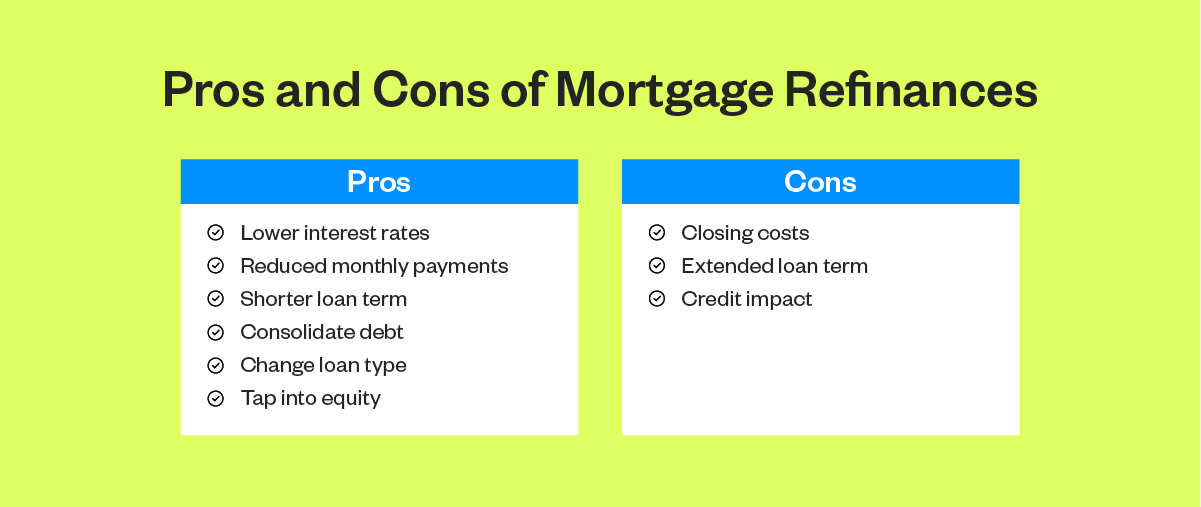

What Are the Pros of Refinancing a Mortgage?

- Lower interest rates: A lower interest rate can significantly decrease the total amount paid over the life of the mortgage

- Reduced monthly payments: If the new loan comes with a lower interest rate or extended repayment term, it can lower your monthly payments

- Shorter loan term: Mortgage refinancing lets you shorten your loan term. Keep in mind that this will increase your monthly payments

- Consolidate debt: Refinancing lets you consolidate debt into a single, lower-interest mortgage payment

- Change loan type: Homeowners may choose to refinance to change their loan type, such as switching from an adjustable-rate mortgage (ARM) to a fixed-rate mortgage or vice versa

- Tap into equity: A cash-out refinance can give you access to the equity you've built in your homes

View all of the loan programs and incentives CCU has to offer here.

What Are the Cons of Refinancing a Mortgage?

- Closing costs: Refinancing involves closing costs, which can include application, appraisal, title search and other fees.

- Extended loan term: Refinancing into a new loan with a longer term can result in lower monthly payments, but it means paying more in interest over the long run

- Credit impact: Applying for a refinance requires a hard inquiry on your credit report, which can temporarily impact your credit score

How Much Does It Cost to Refinance a Mortgage?

Generally, refinancing can cost anywhere from 2% to 6% of the total loan amount. Common closing costs associated with refinancing include:

- Application fee: This is the fee charged to process your loan application

- Appraisal fee: An appraisal is always required to determine the value of your home

- Credit check fee: Lenders typically charge a fee to pull your credit report and assess your creditworthiness

- Origination fee: This fee covers the lender's administrative costs for processing the loan

- Attorney fees: In some cases, you may need to pay legal fees related to the refinancing process

Wrapping Up: Understanding Mortgage Refinancing

Whether you want to lower your monthly payments, save money by getting a better interest rate or tap into your home equity, understanding how mortgage refinancing works and how it can impact you is crucial. At California Credit Union, we understand the importance of finding the best refinancing option tailored to your needs. Enjoy the benefits of a credit union and get competitive rates, personalized service and a commitment to your financial well-being when you refinance through California Credit Union.

Terms and Conditions

Federally Insured by NCUA. Equal Housing Opportunity. NMLS# 401403.

All loans subject to approval. Other restrictions may apply. Programs, rates, terms and conditions are subject to change.