How Does Refinancing a Car Work?

Refinancing a car can be a smart financial decision, as it allows you to replace your current car loan with a new one, usually to get a lower interest rate or change the loan term. As a result, this can reduce your monthly car payment.

So, how does refinancing a car work? In this article, we'll help you improve your financial literacy by exploring the ins and outs of car refinancing, including when you might consider it, how the process works and what you need to know before making a decision.

What Is a Car Refinance?

An auto loan refinance is a type of loan that replaces your existing car loan. The main goal of auto refinancing is to get better terms, which may include a lower interest rate or a more manageable monthly payment. Refinancing your auto loan may help you reduce the overall cost of your loan, pay off your car faster or free up some cash when creating a budget.

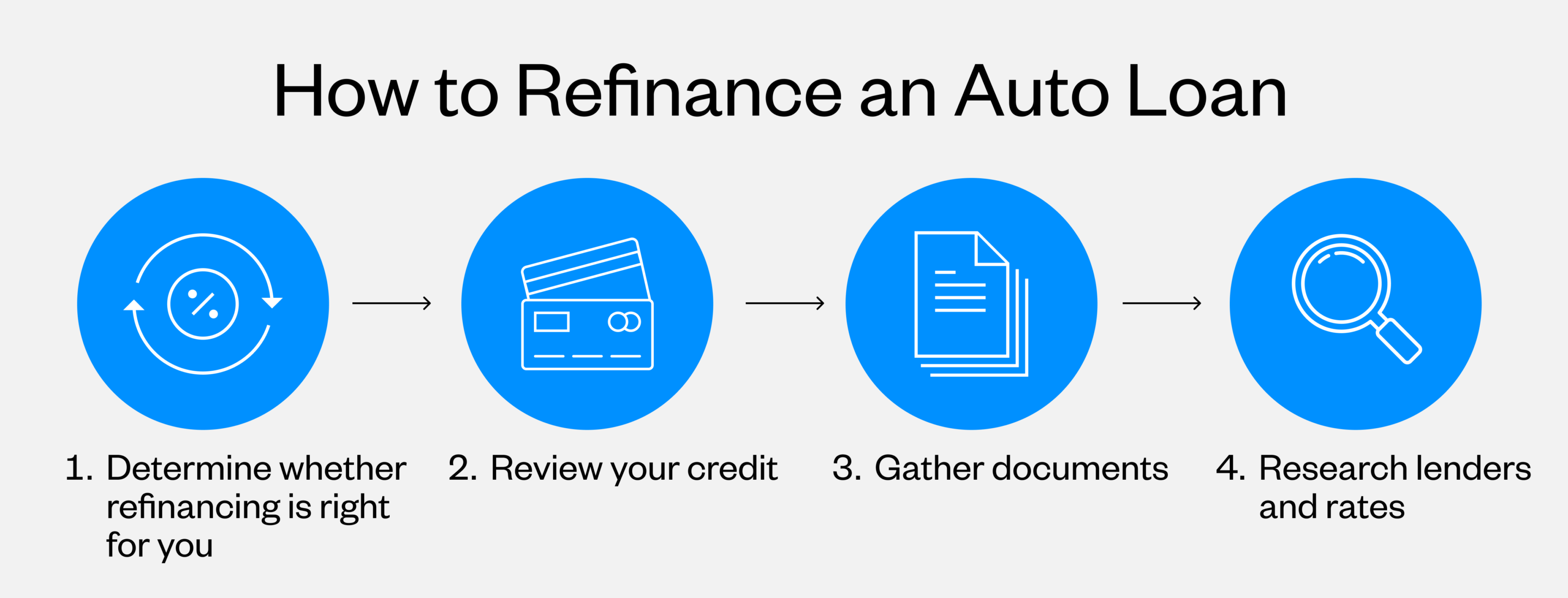

How Do You Refinance a Car?

1. Determine whether refinancing is right for you

The first step in auto refinancing is to assess your financial situation. Consider your current interest rate, monthly payments and whether you're behind on payments. Additionally, evaluate the age and condition of your vehicle, as older cars may not qualify for refinancing.

2. Determine whether refinancing is right for you

Before applying for any new loan, you'll need to review your credit. A higher credit score generally results in better loan terms, such as a lower interest rate. Understanding your credit standing can help you receive the best possible terms for your new auto loan.

3. Gather documents

Once you've decided that refinancing is the right choice, the next step is to gather all the necessary documentation to complete your application. You'll typically need the following:

- Driver's license

- Proof of insurance

- Vehicle registration

- Proof of employment

- Social Security number

- Vehicle identification number

- Current auto loan information (interest rate, monthly payment, remaining balance, time left on loan, current milage, etc.)

4. Research lenders and rates

Always shop around for lenders to compare rates and terms. Consider multiple options, including banks, credit unions and online lenders, to find the best deal. Different lenders offer different rates and terms, so taking the time to research and compare can result in significant savings.

5. Apply for your auto loan refinance

Once you've found a lender that offers favorable terms, the next step is to apply to refinance your auto loan. This means completing the necessary paperwork and providing the documentation you've gathered. After you've submitted your application, your chosen lender will review it, verify your information and perform a credit check.

After approval, you'll finalize the paperwork, and the new loan will replace your existing one. This new loan will come with new monthly payments, a new interest rate and potentially a new loan term. Make sure you understand all the details of your new loan agreement before signing.

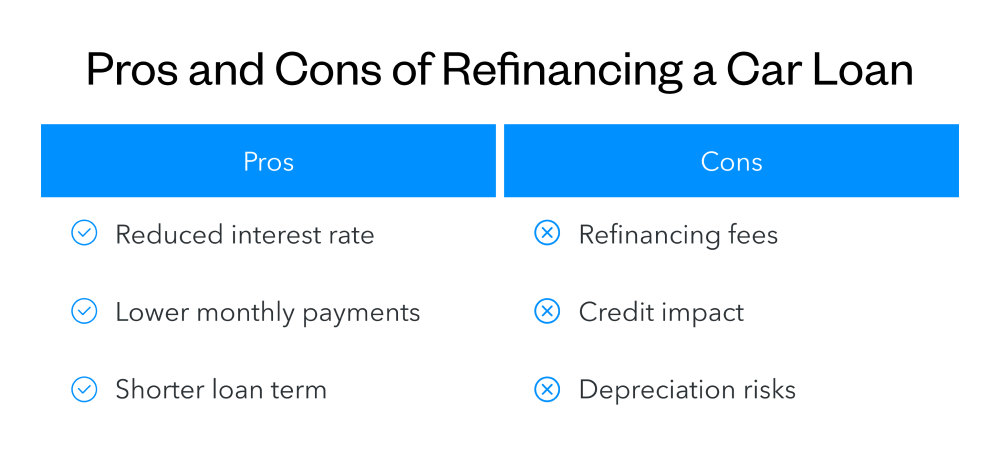

What Are the Benefits of Refinancing an Auto Loan?

- Reduced interest rate: If your credit score has increased since you first borrowed money to purchase your car or market interest rates have dropped, you could qualify for a reduced rate

- Lower monthly payments: Increasing the loan term or reducing the interest rates decreases how much you'll pay on the loan every month

- Shorter loan term: If you're in a position to pay more each month, refinancing your auto loan can allow you to shorten the loan term. By doing so, you'll pay off your car loan faster, which means you'll pay less interest overall

What Are the Drawbacks of Refinancing an Auto Loan?

- Refinancing fees: Refinancing comes with various fees, including application, title transfer and loan origination fees. These costs can add up and may offset the savings you gain from a lower interest rate or reduced monthly payments

- Credit impact: Applying for a new loan involves a credit check that results in a hard inquiry on your credit report. This action can temporarily lower your credit score. Additionally, opening a new loan can affect your credit history and score

- Depreciation risks: Cars depreciate over time, and refinancing a vehicle that has significantly decreased in value can be risky. If your car's value has dropped below the amount you owe on your loan, you may end up owing more than the car is worth

Wondering if an auto refinance is right for you? As a member of California Credit Union, you can take advantage of our financial counseling services to help you determine the right financial moves for you.

Understanding Auto Loan Refinances: When to Refinance Your Car Loan

Refinancing your car loan can improve your finances by securing better loan terms, reducing your interest rate and lowering your monthly payments. California Credit Union is committed to helping you achieve your financial goals. With competitive rates, flexible terms and a dedicated team to assist you, California Credit Union is a great choice for financing your auto loan. Members can contact us today to learn more about how we can help you find ways to save money and manage your finances.