10 Tips on How to Save Money

Saving money is more important than ever. Whether your goal is to build an emergency fund, save for a vacation or plan for retirement, having a specific target helps you stay motivated and track your progress.

From budgeting techniques to savvy shopping strategies, let these tips empower you to make the most of your income and save more. Keep reading for our ten tips on how to save money:

1. Assess Your Financial Situation

Take a comprehensive look at all sources of income, including salaries, bonuses, side hustles and any other sources of revenue. Next, track your spending habits meticulously. You can use budgeting apps, spreadsheets or even pen and paper to monitor incoming and outgoing money. When tracking your spending habits, be sure to include all monthly bills such as utilities, phone, internet, and insurance.

Categorize your expenses into essentials like rent, groceries, and bills (e.g., electricity, water, and other recurring payments). Then, make a list of non-essentials like entertainment or subscriptions.

2. Set Financial Goals

Make your money goals specific, measurable, achievable, relevant and time-bound (SMART). Start by identifying your savings goal—whether it's a short-term goal like a new gadget or a long-term goal such as a home down payment. Determine how much you need to save and by when. Break your goal into smaller milestones to make progress more manageable. Finally, you can think about longer-term goals, such as retirement savings.

3. Create a Budget

A budget is a plan for your money. It helps you know how much you have coming in and how much you spend. Creating a better budget ensures you use your money wisely.

To make a budget, take the income and expenses you calculated in tip one (above) to give you a clear picture of what’s coming in and going out. With this information, you can look for ways to cut back, like eating out less or canceling subscriptions you don’t need.

4. Automate Transfers

One of the most important tips for saving money is automating transfers from your checking account to your savings account or other accounts. This method helps you save consistently, and you can set up transfers to happen on payday or at regular intervals, like weekly or monthly.

When creating your budget, you can also allocate a portion of your income toward your specific savings goals. A good strategy is to automate transfers to your savings account to ensure consistent progress toward your financial goals. Set up an automatic transfer to your savings account each time you receive your paycheck. This way, a portion of your income is saved before you have a chance to spend it.

5. Identify Areas to Cut Spending

With your budget in hand, you should know how many of your expenses are necessities and how many are non-essential. Cutting spending means identifying ways to spend less money on the items you don’t really need, allowing you to save more. Some areas where you might be able to save include groceries (for example, buying in bulk or choosing store brands), subscriptions, eating out, entertainment and more. When shopping for groceries, clothing, or household items, look for deals, discounts and coupons to maximize your savings. Many retailers offer weekly specials or loyalty programs that can help you save even more.

You can also review your monthly bills and look for opportunities to save—such as switching to a more affordable cell phone plan, negotiating your cable or internet rate, or canceling services you no longer use.

6. Reduce Debt

Debt can significantly affect how much you can afford to put toward savings while also impacting your credit score and ability to secure financing when needed. When you have less debt, you save money because you won’t be paying as much interest, which is the fee for borrowing money from a bank, credit card company or lender.

Common types of debt include student loans, auto loans, mortgage and credit card debt. Building good credit and paying off debt helps to frees up money you can put into your savings.

7. Consider Refinancing

Refinancing replaces your current loan – home, auto, personal or student loan — with a new one that often has better terms like a lower interest rate or longer repayment period. This loan can help you save money in the long run because it can lower your monthly payments or reduce the total amount you’ll pay over time in interest.

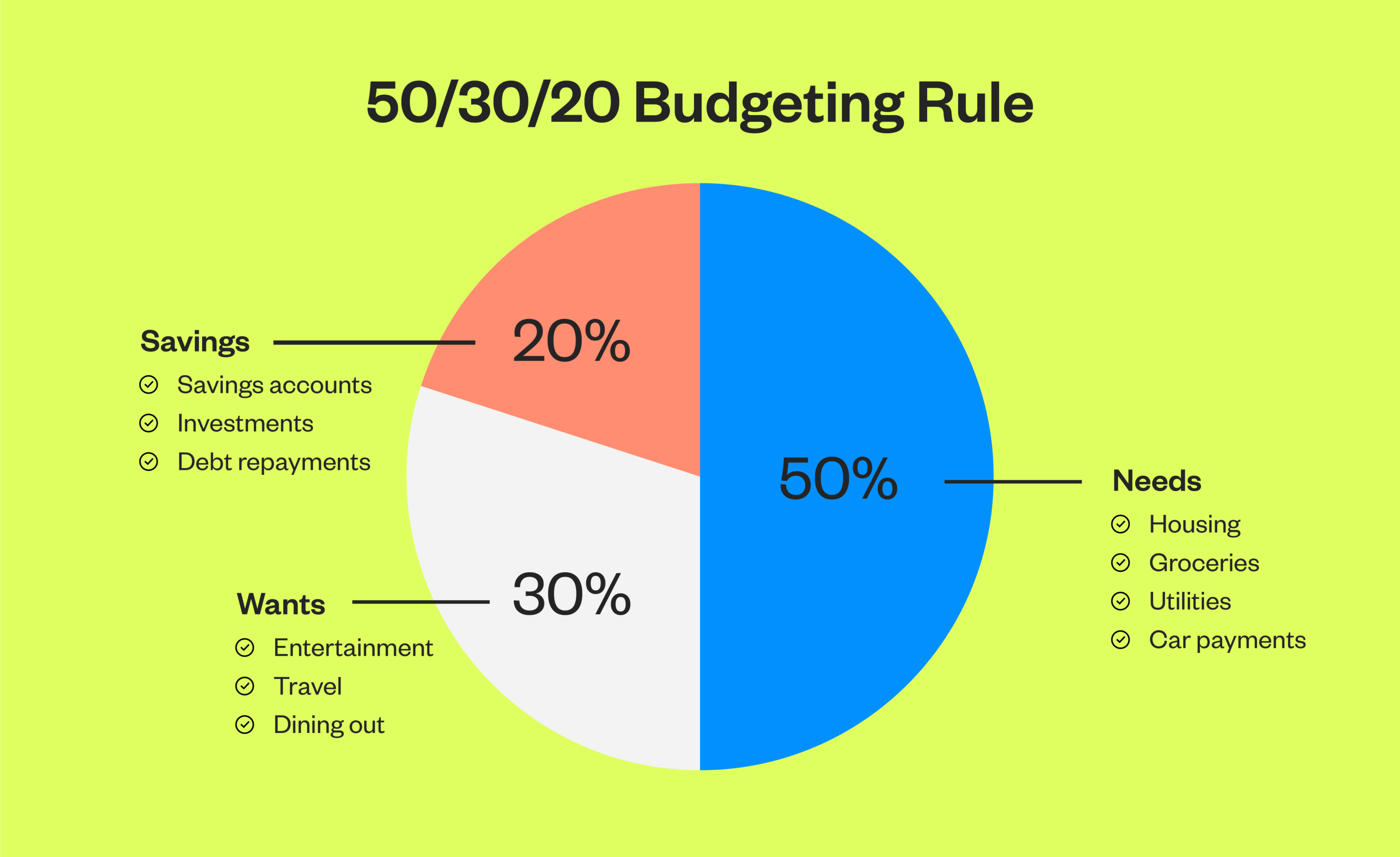

8. Follow the 50/30/20 Rule

The 50/30/20 rule is a budgeting principle to help you manage your money better. Here’s how it works:

- 50% for needs: Allocate 50% of your income to cover essentials like rent or mortgage, groceries, utilities, transportation and minimum debt payments. Groceries and home-cooked meals fall under essentials, while dining out is a discretionary expense you can limit to save more.

- 30% for wants: Use 30% of your income for discretionary spending — the things you won’t but don’t necessarily need. This can include dining out, entertainment, hobbies and other non-essential items.

- 20% for savings and debt repayment: Save or use 20% of your income for financial goals like building an emergency fund, planning for retirement or paying off debt faster.

9. Leverage Technology and Resources

Using tools and tech can make managing your money easier and help you become more financially savvy while learning how to budget and save money. A few tools you can use include:

- Budgeting apps: Budget apps can track your spending, categorize expenses and set savings goals.

- Money trackers: Use these tools to monitor your expenses and income, identify trends and adjust your budget as needed.

- Online resources: Read blogs, articles, podcasts and videos that offer tips, advice and strategies for better money management.

- Financial education: Try free financial counseling services to improve your financial literacy. Talk to an advisor at your bank or credit union about budgeting, saving and investing, debt management and retirement planning.

10. Consider a Money Market Account

A money market account is essentially a credit union or bank’s version of a high-yield savings account. These accounts pay higher interest rates than most typical savings accounts. This means you can grow your money faster over time.

Money market accounts also give you easy access to your money. You can typically withdraw through checks, debit cards or electronic transfers.

Key Takeaways: How to Save Money

Learning how to save money is a process that involves assessing and reassessing your financial situation, setting goals and creating a budget that aligns with those goals. At California Credit Union, we understand the importance of saving money and can help you achieve your financial goals. From money market accounts to personalized financial guidance, we’re here to help you make the most of your money. Become a member to start saving today.