How to Use a Credit Card

Credit cards offer convenience and flexibility when making purchases, but they also come with responsibilities. Knowing how to use a credit card can prevent financial troubles and help you build a good credit history.

In this article, we’ll build on your financial literacy by exploring the essential aspects of using a credit card wisely. Whether you’re a seasoned credit card user or a beginner, this information will provide you with the knowledge needed to make the most of your credit card while avoiding potential pitfalls.

How Do Credit Cards Work?

Credit cards are financial instruments that allow individuals to make purchases on credit, essentially borrowing money from a financial institution like a bank or credit union to buy goods and services.

To obtain a credit card, you typically need to apply with a bank or credit card issuer. The application process involves providing information about your income, employment and financial history. Based on this information, the issuer will decide whether to approve your application and what credit limit to assign your card.

Each credit card comes with a credit limit — the maximum amount you can borrow on the card. This limit is determined by the issuer based on your creditworthiness. Exceeding your limit can result in fees and negatively affect your credit score.

How Do You Use a Credit Card?

Using a credit card is a common and convenient way to make purchases both in-person and online. To use it effectively, you typically need some key information, including your card number, expiration date and the CVV security code — the three-digit code on the back of your card.

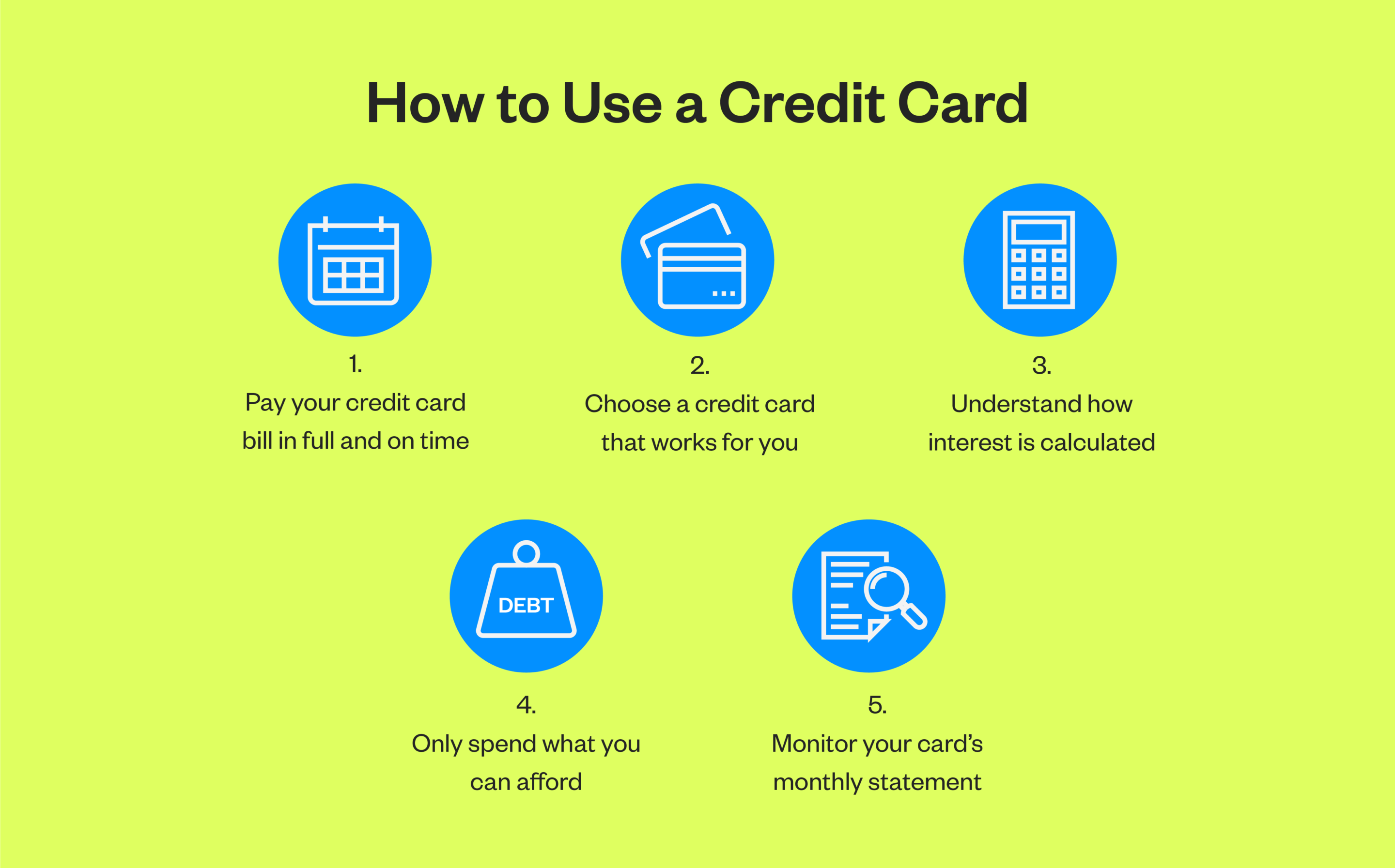

Here are a few tips to help you use a credit card responsibly:

1. Pay your credit card bill in full and on time

When you pay your bill in full and on time, you avoid accruing interest on your outstanding balance and late payment fees that credit card issuers impose for missed due dates. These penalties can add up quickly and increase your overall debt. Additionally, consistently making on-time payments is a positive factor in building and maintaining a good credit score.

2. Choose a credit card that works for you

Credit cards come in various types, each offering different perks and benefits. For instance, the Platinum Visa card at California Credit Union is ideal for those looking for simplicity and a lower interest rate with no annual fees. Other options include the Rewards Visa, which can be a great choice if you’re looking for ways to save and want to earn rewards on your spending, or the Share-Secured Platinum Visa and Share-Secured Rewards Visa cards, which provide a way to build or rebuild credit.

3. Understand how interest is calculated

Credit card interest is typically expressed as an annual percentage rate (APR), which is the interest rate you’re charged for carrying a balance on your card. You can use this credit card rate change calculator to determine how interest rate changes may affect your balance. Keep in mind that credit card interest can compound, which means you’re charged interest on both the principal balance and any previous accrued interest. To minimize interest costs, it’s best to pay your balance in full or as much as possible each month.

4. Only spend what you can afford

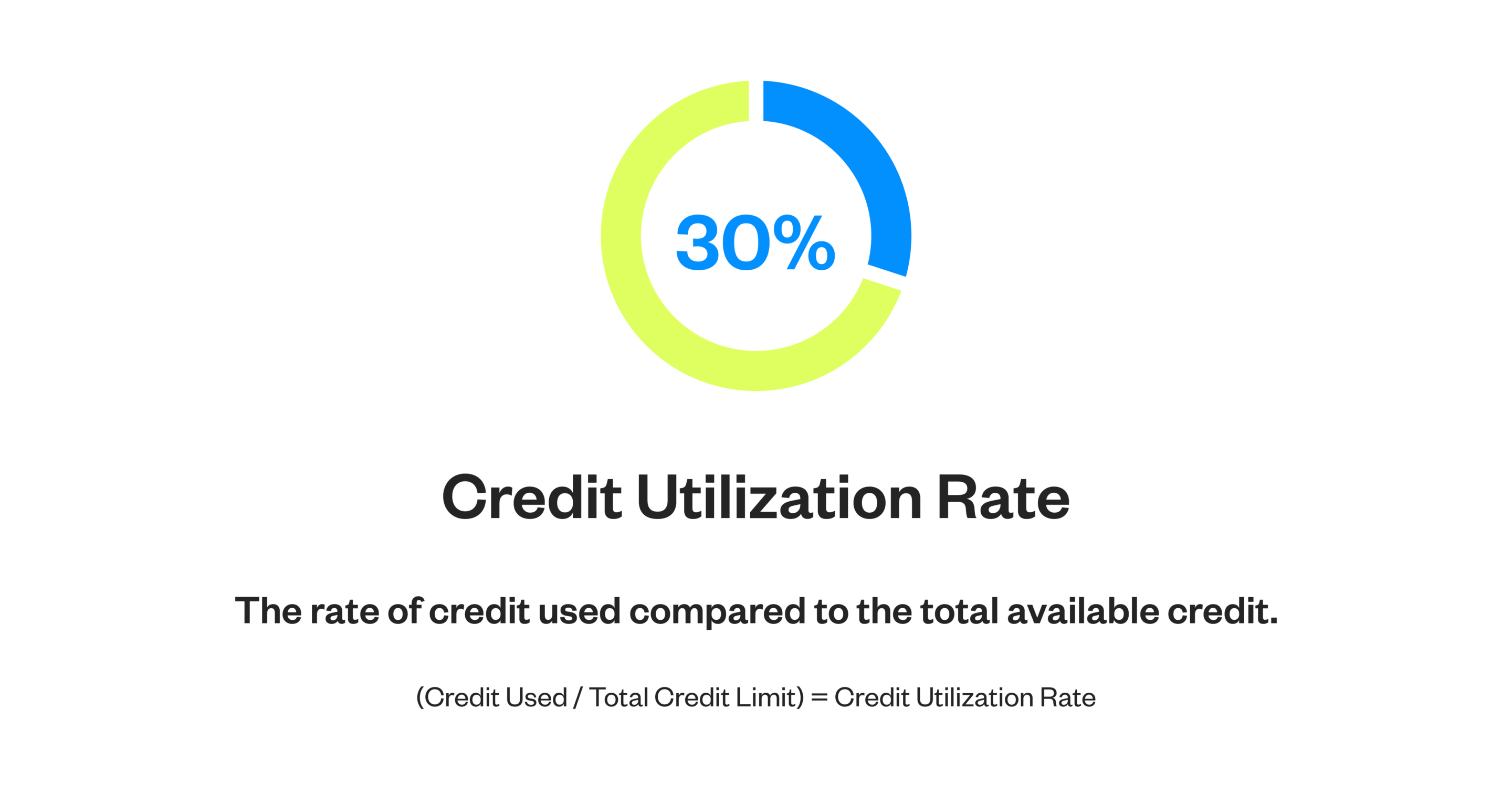

The best way to use a credit card is to only spend what you can afford. Maxing out your credit card can lead to high-interest charges and financial consequences like credit card debt. To maintain a healthy credit score, aim to keep your credit utilization below 30%.

Responsible credit card use involves creating a budget, tracking expenses and paying your balance in full each month to avoid interest charges and high credit utilization.

5. Monitor your card’s monthly statement

Monitoring your credit card’s monthly statement lets you quickly detect and report any unauthorized or fraudulent charges, ensuring your financial security. Additionally, monitoring your statement allows you to stay informed about your spending habits, supporting responsible budgeting and helping you avoid late payment fees.

How Can You Use a Credit Card to Build Credit?

Knowing how to use a credit card to build credit can improve your credit score and make you more creditworthy. Credit scores are a critical measure of your financial reliability, influencing your ability to secure loans, obtain favorable interest rates and impact various aspects of your financial life. These scores are calculated based on several key factors, such as:

- Payment history: Your payment history reflects how consistently you’ve met your credit obligations, including credit card payments. To build a positive payment history, it’s essential to always pay your credit card bills on time

- Credit utilization: Credit utilization is the percentage of your available credit that you’re using. Lower credit utilization is generally better for your credit score

- Credit mix: Having a diverse mix of credit accounts, including credit cards, can positively impact your credit score

- Credit history: To build a good credit history, it’s recommended to keep your first credit card open to help maintain a longer average age of your credit accounts and to avoid frequently opening new cards

Key Takeaways: How to Use a Credit Card

Mastering how to use a credit card can be a powerful financial strategy. By understanding how your card works, making timely payments and using its benefits wisely, you can avoid financial troubles and build a solid credit history.

At California Credit Union, we’re here to support your financial journey with a range of credit card options. We understand that responsible credit card use is the cornerstone of sound financial management, and we’re here to help you make the most of your credit card while securing your financial future. Become a member today to explore the benefits of a credit union.