Compound Interest: How Does Compound Interest Work?

Discover How Compound Interest Can Help Your Money Work For You

Compound interest is a concept that can significantly impact your savings and investments. At its core, it is the process where interest on your money earns interest itself, leading to exponential growth over time.

In this article, we'll teach you the mechanics of compound interest to help you understand how it works and how to use it to maximize your financial gains. Whether saving for retirement, investing in the stock market or looking to better understand your finances, learning about compound interest is crucial.

What Is Compound Interest?

Compound interest is a financial concept crucial for estimating retirement income needs and comparing various savings vehicles. It refers to the process in which interest is added to the principal amount of a deposit or loan, and then is earned on the enhanced amount. Ultimately, you earn interest on the initial principal and previously accumulated interest in subsequent periods.

Unlike simple interest, where interest is calculated on the principal of the initial amount, compound interest takes into account the increasing value of the principal as it accrues interest over multiple periods. This results in a snowball effect. As interest is added to the principal, the total grows larger and the interest calculated in the next period is based on that increased sum.

For instance, if you invest $1,000 at an annual interest rate of 10%, you'd earn $100 in interest with simple interest after the first year. With compound interest, you'd still earn $100 the first year if it's compounded annually. However, during the second year, interest would be calculated on the new total of $1,100, resulting in $110 in interest for that year, making the new total $1,210 and so on.

For those approaching retirement, the true impact of compound interest becomes more evident over extended periods. As time passes, the amount of interest earned each period grows, increasing the total sum at an accelerated rate. This is why compounded interest is often described as making your money "work for you." The longer your money is invested or saved, the more apparent the effects of compound interest are, emphasizing the importance of long-term financial planning and early investing.

When Can Interest Be Compounded?

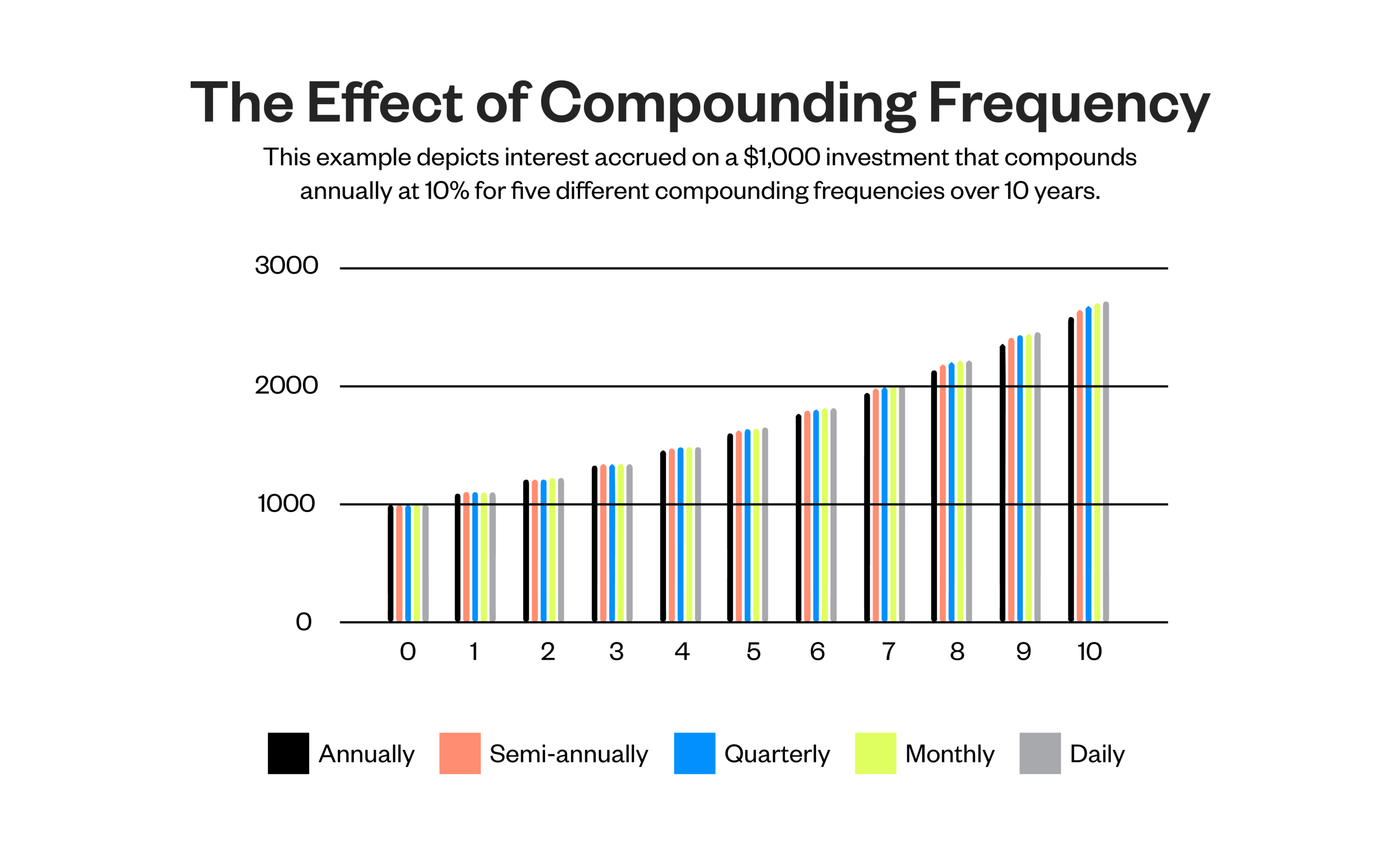

Compound interest can be calculated based on various periods, ranging from annually to continuously. The frequency interest compounds can significantly impact the amount of interest you earn or owe. Some of the most common compound interest periods include:

- Annually: Interest is added to your principal once a year. Annually, compounded interest is straightforward, allowing you to earn interest on the principal once a year. Then the next year, you'll earn interest on the new total. This frequency is typically used on long-term investments like dividend stocks and some certificates of deposit (CDs).

- Semi-annually: Interest is compounded twice a year. With semi-annually compounded interest, you earn interest on the principal after six months and interest on the new total six months later. Bonds, especially corporate and treasury bonds, commonly use this type of compounding.

- Quarterly: Interest is added to the principal four times a year. Compounding interest quarterly means that interest is calculated and added to the principal every three months, resulting in higher growth. Some savings accounts and investment products might offer this type of compounding.

- Monthly: Interest is compounded monthly or twelve times a year. Monthly compounding can lead to significant growth, especially over a long period, since interest is calculated and added every month. Many modern savings accounts, especially online banks, offer monthly compounding.

- Daily: Compounding daily maximizes the interest you earn, growing your balance every day. Some high-yield savings accounts use daily compounding to offer the best returns.

- Continuously: Interest is added to the principal continuously, resulting in exponential growth. Continuously compounded interest is the highest level of compound interest.

How Can You Maximize Compound Interest?

Compound interest grows wealth over time and makes your money work for you. The better you maximize it, the more you can earn. Here are a few strategies to consider:

- Start saving early: The earlier you start investing or saving, the more time your money has to compound. Even if contributions are smaller, someone who starts saving in their 20s can accumulate more wealth by retirement than someone who starts in their 30s or 40s.

- Make consistent, automated contributions: You can maximize compound interest by making consistent contributions over time. By automating your investments or savings, you ensure that you continually feed them, allowing them to grow steadily. Additionally, creating a budget can help you determine how much you can invest regularly, taking full advantage of compound interest.

- Take advantage of employer-sponsored retirement plans: Many employers offer retirement savings plans where they'll match your contributions up to a certain percentage. This is essentially free money that can compound over time.

- Diversify your portfolio: Diversification can maximize returns while mitigating risks. Different assets like stocks, bonds and real estate can respond differently to market conditions. By diversifying, you can increase the chances of having investments that are performing well.

Additionally, financial counseling can offer guidance on maximizing your returns, helping you understand where and how to save or invest.

What Are the Pros and Cons of Compound Interest?

Understanding the advantages and disadvantages of compound interest can help you make more informed decisions about your finances. Let's take a look at a few pros and cons of compound interest:

Pros of compound interest

The advantages of compound interest include:

- Accelerated growth: One of compound interest's most enticing benefits is its exponential growth. Unlike simple interest, compound interest earns on the initial principal and accumulated interest.

- Inflation protection: Compound interest can potentially offset the impact of inflation. By consistently reinvesting the interest, the value of your retirement can grow at a rate that outpaces inflation.

- Passive income: With compound interest, your money essentially works for you. The interest starts compounding once the initial investment is made, providing a passive income stream.

Cons of compound interest

The cons of compound interest primarily have to do with borrowing and debt:

- Debt accumulation: Interest on loans or credit cards can compound, leading to rapidly growing debt that can make it challenging to break free from the debt cycle.

- Cost of borrowing: Borrowing funds that come with compound interest can be more expensive in the long run than those with simple interest.

- Time commitment: When it comes to investments, time is crucial for compound interest. Short-term investments don't reap significant benefits from compounding interest, so it's typically best suited for long-term investments.

Key Takeaways: What Is Compound Interest?

Compound interest can be equally beneficial and hurtful, depending on the type of financial product. For investments, compound interest can grow your wealth while increasing your debt on loans and credit cards.

To maximize the potential of compound interest, California Credit Union offers an array of financial products tailored to your needs. From savings accounts to long-term growth strategies, we provide the tools and expertise you need to take control of your personal finances. Become a member today to experience the benefits of a credit union.