What Is a Money Market Account?

A money market account (MMA) is a financial product available at banks and credit unions that combines the benefits of savings and checking accounts. These accounts offer higher interest rates compared to traditional savings accounts while providing checking account benefits like check-writing capabilities and ATM access.

So, what is a money market account? Keep reading to improve your financial literacy and learn more about these accounts, how they work and their benefits.

What Is a Money Market Account?

A money market account is a deposit account designed to blend higher interest rates and transactional flexibility. These accounts are considered a low-risk option for individuals who want to earn interest on their cash reserves while maintaining access to their money.

However, opening and maintaining these accounts often requires higher minimum balance requirements. Still, there are protections through insurance. Money Market Accounts are insured by the National Credit Union Administration (NCUA) when held at credit unions and the Federal Deposit Insurance Corporation (FDIC) when held at banks. This means your deposits are safeguarded up to $250,000 to protect you. However, federal regulations may impose transaction restrictions on money market accounts.

How Do Money Market Accounts Work?

Money market accounts are designed for those who want competitive interest rates with some degree of liquidity. They function similarly to a savings account but have some distinct features. Here’s a quick rundown of how they work:

- Account setup: You can set up a money market account at a credit union or bank. The setup usually involves providing personal information, meeting the institution’s minimum deposit requirements and understanding the account’s terms and conditions.

- Money market rates and earnings: One of the key features of MMAs is their interest rates, which are typically higher than standard savings accounts. The interest is calculated using the daily balance method to ensure every cent earns interest daily. This interest is also compounded — calculated on the principal and the accumulated interest.

- Liquidity: Liquidity refers to how quickly assets can be converted into cash. MMAs are highly liquid, allowing you to access your funds. These accounts also come with added conveniences like writing checks and using debit cards.

- Transaction limits: MMAs offer transactional flexibility but still have limits

As with any financial decision, you should fully understand your options. If you’re unsure about how a money market account fits into your financial strategy, seeking financial counseling may be beneficial.

What Are the Advantages of Money Market Accounts?

Money market accounts combine the growth potential of investment platforms with the accessibility and security of traditional banking. One significant feature of managing your finances better is building a better budget. Integrating an MMA into your savings strategy can potentially help you build wealth faster.

A few of the key advantages of these accounts include the following:

- Higher interest rates: One of the primary draws of MMAs is their competitive interest rates, which are often much higher than traditional savings accounts. This means that while your money remains liquid, it’s also working harder for you.

- Safety and security: MMAs are insured by the National Credit Union Administration (NCUA) when held at credit unions and the Federal Deposit Insurance Corporation (FDIC) when held at banks. This means your deposits are safeguarded up to $250,000 to protect you if the institution fails.

- Check-writing abilities: While standard savings accounts typically don’t allow for check-writing, MMAs do. The hybrid nature of this account means you can earn competitive interest rates while still having the convenience of writing checks from your account.

- Debit cards: Adding another layer of convenience, many MMAs come with debit cards that allow direct access to your funds at ATMs or point-of-sale transactions.

- Stability: Stocks and mutual funds aren’t for everyone because they can be volatile. However, MMAs provide a more stable alternative because they’re not subject to market fluctuations, ensuring your principal remains intact. While they might not offer high returns compared to riskier investments, they can provide a steady, predictable growth rate.

What Are the Disadvantages of Money Market Accounts?

These accounts aren’t the right option for everyone. As with all types of investments, weighing the pros and cons can help you make a more accurate decision. While MMAs offer unique benefits, they can also come with specific limitations and drawbacks, such as:

- Limited transactions: MMAs have a transaction limit that caps the number of certain transaction types you can make each month. This restricts activities like electronic transfers, check-writing and debit card transactions. Exceeding this limit often results in fees.

- Lower yields than riskier investments: MMAs offer interest rates higher than standard savings accounts. However, their yields are considered modest compared to riskier avenues like stocks and bonds. Money market accounts provide stability, but they may not satisfy investors looking for more aggressive growth or high returns on their investments.

- Minimum balance requirement: Many money market accounts stipulate a minimum balance requirement. To take advantage of higher interest rates and avoid fees, you’ll need to maintain that set balance.

- Fees: Some money market accounts come with fees that can erode the interest earned. Common charges include maintenance fees, excessive transaction fees, or penalties for failing to maintain the minimum balance.

What Is the Difference Between a Money Market Account and Savings Account?

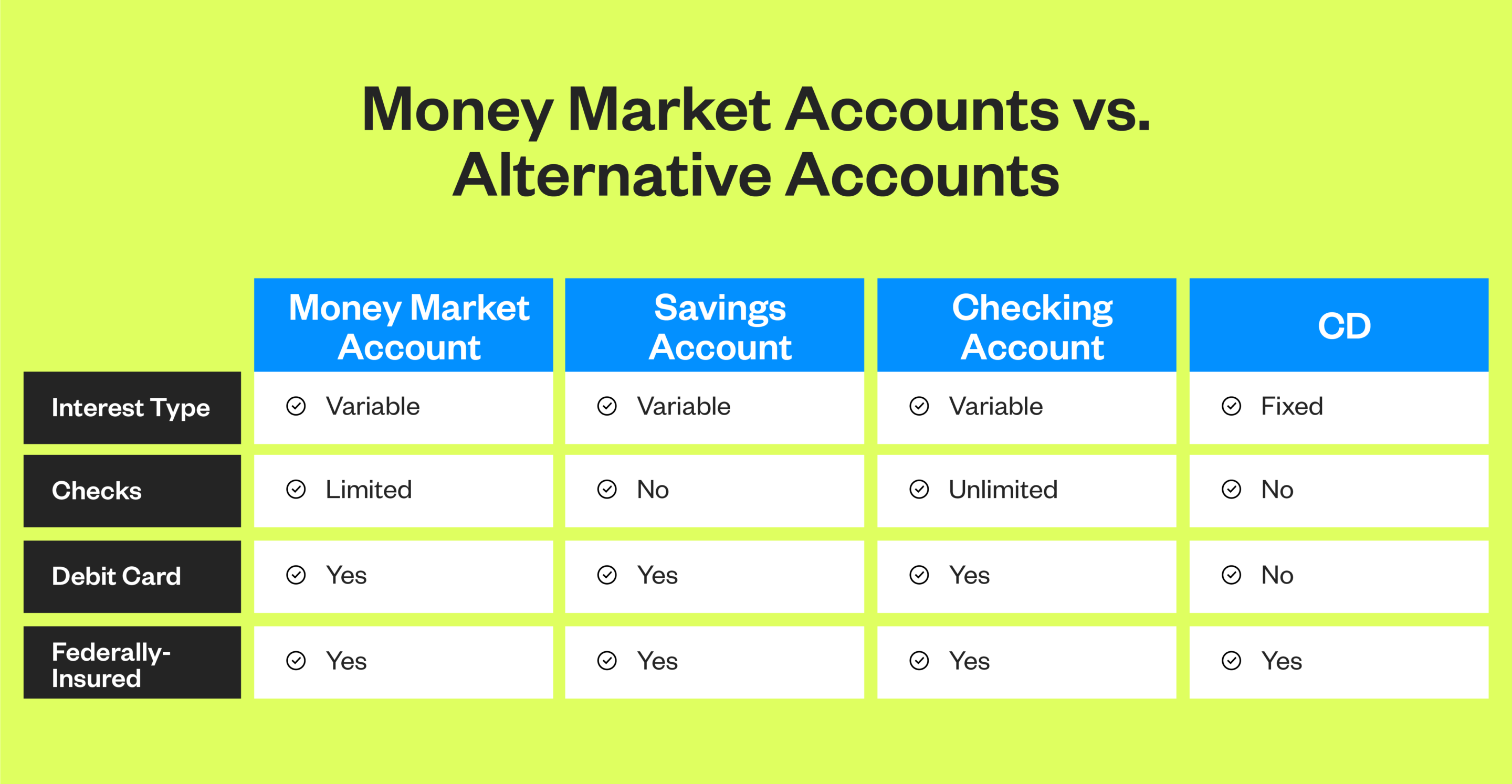

Both money market accounts and traditional savings accounts are deposit accounts offered by credit unions and banks. They both aim to help individuals save and grow their money. However, there are several distinct differences between them.

Again, MMAs offer higher interest rates compared to traditional savings accounts. While both accounts are designed for saving, your money will grow faster in an MMA. Money market accounts also come with added transaction features like check-writing capabilities and a debit card, making your funds more liquid than the standard savings account.

In addition, money market accounts often have higher minimum balance requirements compared to savings accounts. Failing to maintain this balance might result in fees or lower interest rates.

What Is the Difference Between a Money Market Account and a Checking Account?

Checking accounts and money market accounts have two unique purposes, but they share certain features. Both allow for deposits, withdrawals and various transactions. However, checking accounts are primarily transactional. They’re designed to facilitate a high volume of incoming and outgoing transactions, including deposits, bill payments and transfers. These accounts have unlimited check-writing capabilities and a debit card.

While some checking accounts earn interest, these rates are relatively low compared to MMAs. Money market rates are much higher than checking account rates, allowing for more significant growth of deposited funds. In addition, money market accounts may come with higher minimum balance requirements compared to checking accounts.

What Is the Difference Between a Money Market Account and a CD or Share Certificate?

Money market accounts, certificates of deposit (CDs) and share certificates are all personal investing instruments offered by banks or credit unions. However, they have different purposes and features. MMAs blend the elements of savings and checking accounts, offering liquidity and competitive interest rates. This means account holders can access their money while benefiting from higher interest rates than traditional savings accounts. Money market accounts also come with features like limited check-writing capabilities and a debit card.

On the other hand, CDs and share certificates are time-bound savings instruments. When you open a CD or share certificate, you agree to deposit a fixed sum of money for a specified period, ranging from a few months to several years. In return, the credit union or bank offers a higher interest rate for these than money market and savings accounts.

However, the money in the CD or share certificate Is essentially locked in for the duration of the term, meaning you can’t access it. Premature withdrawals before the maturity date usually result in penalty fees, making CDs and share certificates much less liquid than money market accounts.

Wrapping Up: Open a Money Market Account

Money market accounts offer a compelling blend of features that cater to savers and those who want transactional flexibility. These accounts seamlessly merge the convenience of checking accounts and the benefits of higher interest rates to ensure your funds remain liquid for unexpected needs and planned costs and grow at competitive rates for long-term savings goals like retirement.

As you consider money market accounts, it’s important to think about your long-term goals, including retirement planning. To help you make informed decisions about saving for retirement, you can use our retirement savings calculator to determine how much you’ll need to save to achieve your goals.