What Is a Share Certificate?

Discover How Share Certificates Can Earn Dividends and Boost Your Savings

Share certificates are among the numerous ways to save, catering to individuals looking for less volatility and more assurance in their investments. In this article, we'll help you understand share certificates, providing a comprehensive exploration of how they work and what makes them stand out from other savings vehicles.

Share Certificate Definition

A share certificate operates similarly to traditional savings accounts with some distinct characteristics. When you invest in a share certificate, you commit a fixed amount of money to the institution for a set period, ranging from a few months to several years. In exchange, the institution promises to pay dividends on your deposit throughout the term.

Share certificates are different from other savings instruments because they have a distinct term structure. Once funds are deposited, they remain untouched until the maturity date. Withdrawing funds before this date usually results in penalties, which could range from forfeiting a portion of the earned dividends to a more substantial financial penalty, depending on the share certificate's terms and conditions.

The dividends offered on share certificates are also typically higher than those of regular savings accounts, primarily because the depositor commits to leaving their funds untouched for a fixed period.

What Are the Benefits of Share Certificates?

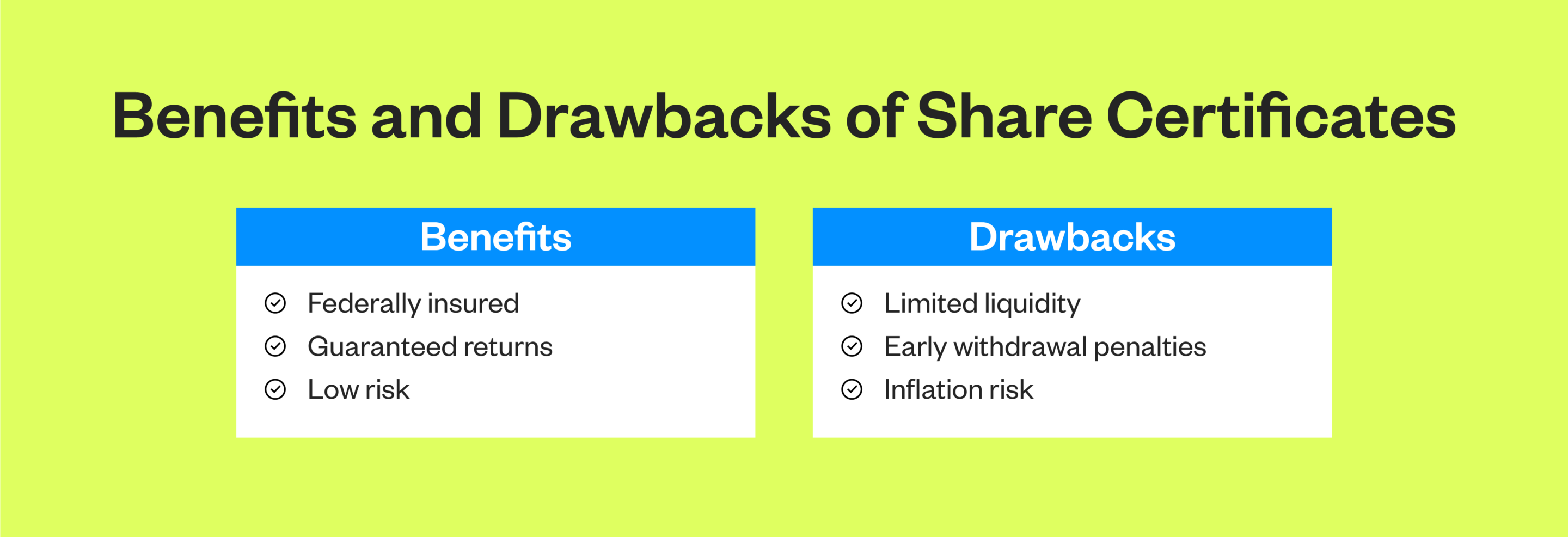

- Federally insured: As one of the many benefits of a credit union, your funds are insured by the National Credit Union Administration up to $250,000.

- Guaranteed returns: This means you can accurately project the growth of your investment from the onset, eliminating the guesswork and anxiety tied to more volatile investment options.

- Low Risk: The principal amount you invest is shielded from everyday volatility in financial markets, making share certificates a preferred choice for more conservative investors.

What Are the Drawbacks of Share Certificates?

- Limited liquidity: Unlike regular savings and checking accounts, where funds can be easily accessed, the capital in a share certificate remains somewhat locked, making it less suitable for those who need quick access to cash.

- Early withdrawal penalties: If you find yourself needing to access the money in your share certificate before the term ends, you'll likely face early withdrawal penalties.

- Inflation risk: In scenarios where inflation rates rise significantly, the real value of the dividends earned on a share certificate might be eroded, leading to diminished purchasing power in the future. If the rate on the share certificate is lower than the inflation rate, you might end up with a net loss even though the nominal value of the share certificate increases.

How Do Share Certificates Differ From Other Savings Vehicles?

CDs vs. Share Certificates

Certificates of deposit (CDs) and share certificates are both time-bound deposit agreements offering guaranteed growth for fixed terms. However, CDs are offered by banks and define their fixed rate of earnings as interest, while share certificates are specific to credit unions and refer to their fixed rate of earnings as dividends. The underlying principle remains the same, but the terms, interest/dividend rates and early withdrawal penalties might differ.

Savings Accounts vs. Share Certificates

A savings account provides liquidity, allowing you to deposit and withdraw funds more freely at a lower interest rate. On the other hand, share certificates restrict withdrawals in exchange for higher rates over a fixed term. While savings accounts might suit daily banking needs and emergency funds, share certificates are tailored for those willing to set aside money for predetermined periods in exchange for higher dividend rates.

How Do Share Certificates Work?

- Open a share certificate account: This process can start online or by visiting a local branch. The institution will guide you through its available products, dividend rates and term lengths, allowing you to make an informed decision based on your financial goals.

- Provide required documents: There are specific documentation requirements for share certificates, such as ID or passport, proof of address and, in some cases, your Social Security number or tax ID.

- Choose a term length: The term you choose will directly impact the dividends you receive. Longer terms come with higher rates but also mean your money will be locked away for a longer period.

- Make minimum deposit requirements: Depending on the specific product, this minimum can range from a modest amount to substantial sums. Before opening a share certificate account, creating a budget can assist in understanding how much you're able to deposit and for how long, aligning with your financial goals

- Maturity and renewal: When your share certificate matures, you can withdraw the principal amount and dividends earned or renew it, allowing the share certificate to roll over into a new term. The right decision for you will ultimately depend on whether you need the money at that point in time or can stand to have it locked away for another extended period.

Wrapping Up: What Is a Share Certificate?

Share certificates offer a unique blend of security, structured returns and flexibility. This structured approach provides predictability in returns and protection against volatile market swings. Share certificates are not only for short-term gains but also play a pivotal role in estimating retirement income needs. With predictable earnings, they can be a cornerstone of a retirement portfolio, ensuring you have a steady growth of funds for the future.

For those looking to enhance their portfolio with a stable investment, now might be the right time to consider investing in share certificates.

California Credit Union is proud to offer share certificates, designed to provide the advantage of CDs but tailored to the unique needs of our members. Whether you're trying to achieve short-term financial goals or planning for long-term growth, incorporating share certificates into your portfolio can improve your financial stability and grow your wealth. Become a member today or visit a local branch to learn more.

Terms and Conditions

Federally Insured by NCUA. Equal Housing Opportunity.

Minimum opening deposit required. Fees may reduce earnings. Penalty for early withdrawal. Terms and conditions subject to change. Visit https://www.ccu.com/bank/personal/share-certificates/ to learn more.