What Is a Good Credit Score?

What Do Credit Score Ranges Indicate?

There are various credit scoring models with different ranges, but for credit scores ranging between 300 and 850, a good credit score is typically around 700 or above. Credit scores are vital indicators of a person’s financial health and creditworthiness. They influence lending decisions, interest rates and sometimes, even job prospects and housing applications.

Keep reading to learn more about credit scores, how they’re calculated and what constitutes a good credit score in the eyes of lenders, banks and credit unions.

What Is a Credit Score?

A credit score quantifies an individual's financial reliability by analyzing their past credit activities, providing a numerical figure lenders and financial institutions can use to determine someone's creditworthiness.

Most common credit scoring models, including FICO® and VantageScore 3.0 and 4.0, use a range between 300 and 850 to represent this score. However, it’s worth noting that some models can have different ranges, such as 501 to 990 or 250 to 900.

As mentioned, the credit score comes from a person’s credit report, a detailed record of their credit history. This report includes various aspects of a person’s financial behaviors, such as the number and types of credit accounts, duration of accounts, outstanding debts and payment histories.

While both the credit score and credit report provide insights into an individual's financial behaviors, they serve different purposes. The credit score offers a condensed snapshot, while the credit report offers a more detailed account of the credit history that resulted in the score.

The three national credit bureaus, TransUnion, Experian and Equifax, compile these reports by gathering financial data on individuals. Then, this information is used by scoring models to generate the credit score.

What Is a Good Credit Score?

What's considered a good credit score can be challenging to understand. There’s no universally accepted threshold that determines the exact score considered “good.” However, there are general guidelines financial professionals use to gauge creditworthiness.

The most commonly used scoring models range between 300 and 850, such as FICO® and VantageScore 3.0 and 4.0. However, these ranges can vary slightly. Some lenders and institutions might consider a score in the high 600s as good, while others might see it as just above average.

Factors like the loan type, lender’s guidelines and economic climate can also influence the interpretation of these scores.

Additionally, other scoring models will have different classifications for what’s considered a good or average credit score.

Building good credit signifies that an individual has historically been responsible with credit, paying off credit card debt and other bills on time and managing debts. The individuals with the highest credit scores are often rewarded with more favorable lending terms, lower interest rates and more financial opportunities.

However, it’s crucial to approach these score ranges as general guidelines because individual financial situations, goals and lender practices can often add layers of complexity to how these scores are perceived.

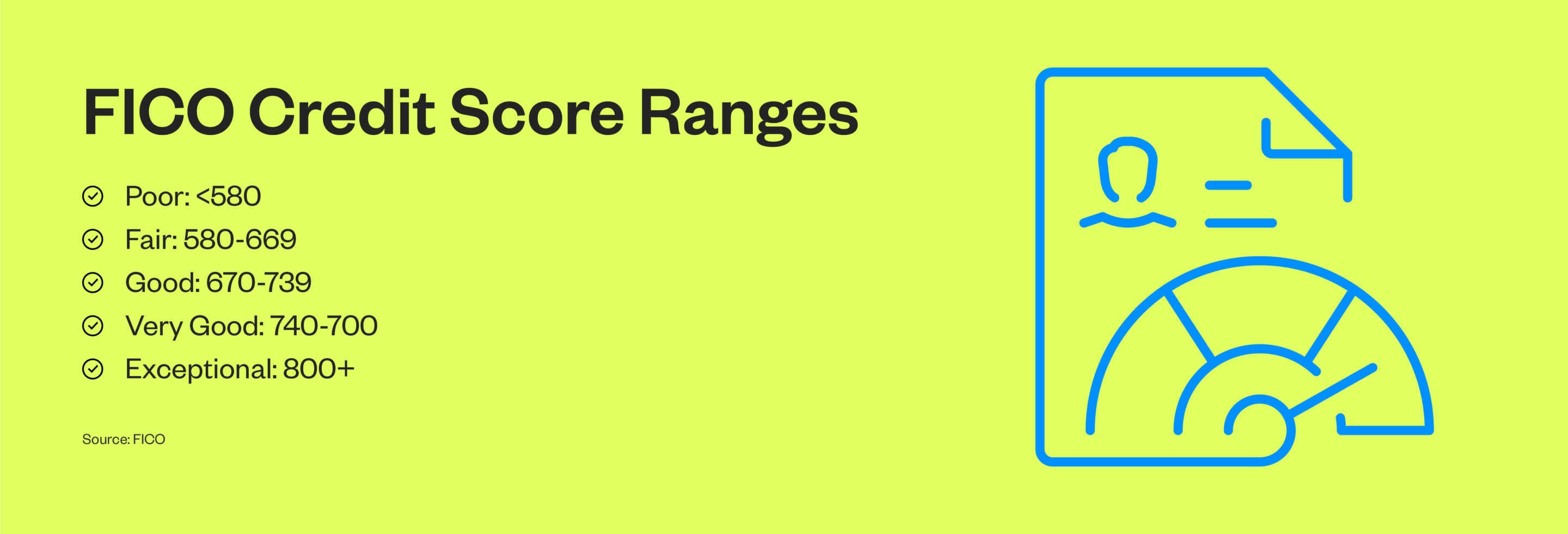

What Is a Good FICO Score?

The FICO® score is derived from the Fair Isaac Corporation, the company that developed this scoring model. FICO® scoring plays a significant role in lending and financial worlds, including decisions about approvals, interest rates and credit limits. By evaluating individual credit reports, FICO® scores offer lenders a numerical representation of an applicant’s credit risk.

FICO® scores start at 300, considered poor credit; the highest credit score available is 850, considered exceptional credit. Within this spectrum, FICO® claims that a good credit score range is between 670 and 739.

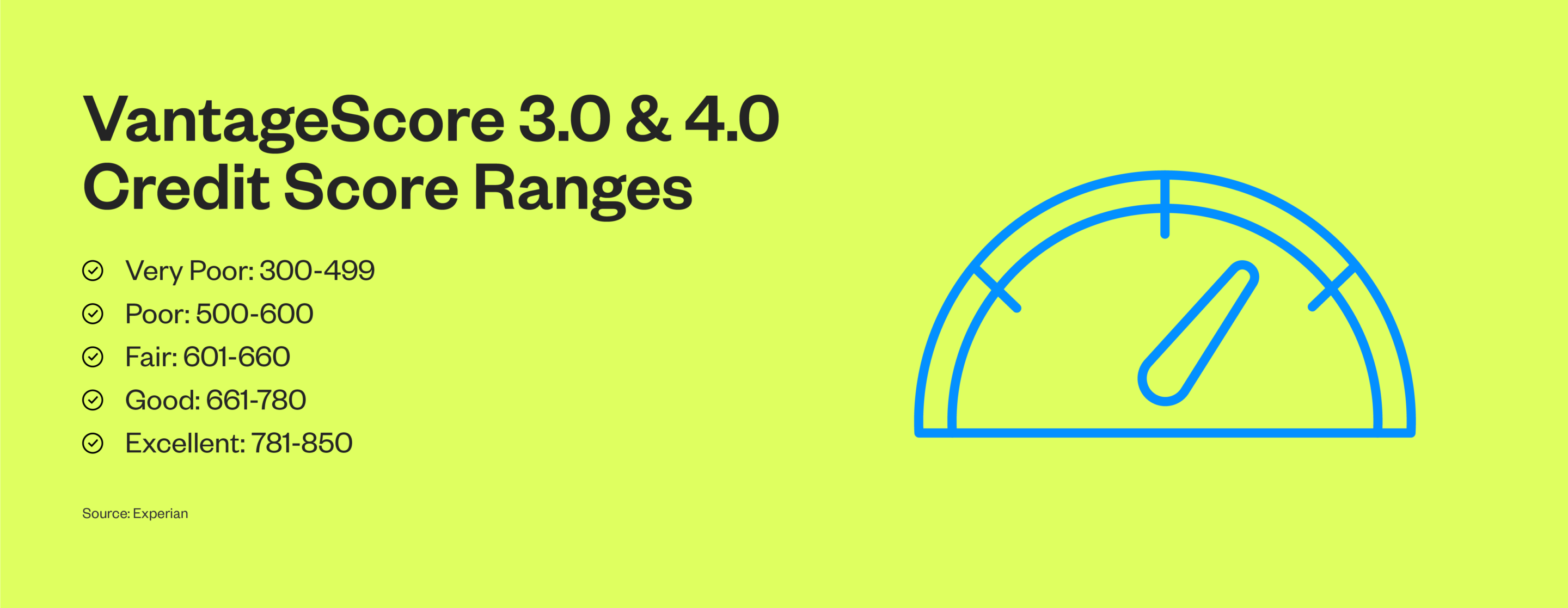

What Is a Good VantageScore?

VantageScore is an alternative to the FICO® score and was developed by the three leading credit bureaus: Experian, Equifax and TransUnion. This score gives lenders and financial institutions a measure of a borrower’s creditworthiness, factoring in payment history, credit usage and overall debt.

Like the FICO® score, the VantageScore scale ranges from 300 to 850. Within this framework, a good credit score range is between 661 and 780.

How Are Credit Scores Calculated?

Credit scores are meticulously calculated using a combination of several key financial factors, each carrying its own weight. The factors that influence your credit score include the following:

- Payment history: Payment history examines whether or not you pay your bills on time. Late payments, bankruptcies and other derogatory marks can have a significant impact. On the other hand, consistently paying on time can greatly improve your score over time.

- Credit utilization: Your credit utilization represents the ratio of your current credit card balances to your credit card limit. A lower utilization rate is viewed more favorably because it means you’re relying less on borrowed funds for everyday expenses. As a general rule of thumb, maintaining a credit utilization ratio under 30% is recommended.

- Length of credit history: Lenders value borrowers with a long history of credit. This factor takes into account the age of your oldest account and the age of your newest account to give an average length of credit. Longer credit histories can lead to higher scores.

- Types of credit accounts: A diverse mix of credit types, such as credit cards, retail accounts, installment loans and mortgages, can be beneficial, demonstrating that you can manage various credit types responsibly.

- New credit: Opening several new credit accounts in a short period can signal higher risk, especially if you have a short credit history. This factor also considers the number of recent inquiries into your credit report. However, certain inquiries, like those for auto loans within a short timeframe, are treated as a single inquiry.

Why Is a Good Credit Score Important?

A credit score reflects responsible financial behavior and can affect various aspects of life. By building a better budget, individuals can avoid unnecessary debts, ensure timely payments and potentially strengthen their credit scores. For instance, someone with a poor credit score may not be able to get financing for a home or car, while someone with an excellent credit score has more options available to them. Let’s look at a few different reasons why credit scores are important:

- Loan approvals: A good credit score acts as a green light for lenders. A higher credit score increases the chances of your loan or credit application getting approved. Essentially, lenders see those with good scores as lower-risk borrowers more likely to repay their debts on time.

- Interest rates: Beyond loan approvals, your credit score can also determine the terms of the loan and interest rate. A higher score can secure more favorable rates, translating to potentially thousands of dollars in savings over the life of a loan. Conversely, a lower score might mean higher interest rates, making the cost of borrowing more expensive.

- Rental applications: Landlords prefer reliability. A good credit score tells lenders you pay your bills on time, making you more likely to pay your rent on time. A poor score might require larger deposits or even result in rejected applications.

- Employment prospects: While it might seem unrelated, certain employers check credit scores as part of their hiring process, especially for positions that involve financial responsibilities. A good credit score can reflect financial stability, which may be considered a sign of responsibility and reliability.

- Insurance premiums: Some insurance companies use credit scores to determine auto and homeowner’s insurance premiums. A better credit score can lead to reduced premiums since individuals with good credit scores are considered less risky.

How Can You Improve Your Credit Score?

Now that you understand how a credit score can impact your life, you may want to start focusing on improving yours. If you're juggling multiple credit card debts, consider using a credit card consolidation calculator to assess if consolidating your balances could benefit your financial situation and potentially improve your credit score. A low credit score can feel like an anchor, but it’s not permanent. By remaining diligent, you can increase your credit score and improve your financial health over time. Here are a few tips to help:

- Pay bills on time: Each late payment can negatively impact your credit score. By ensuring all bills are paid on or before the due dates, you’re laying the foundation of reliability that credit bureaus value.

- Keep credit utilization low: Keeping your credit utilization ratio below 30 indicates financial discipline and minimizes perceived risk, increasing your credit score.

- Maintain a diverse credit mix: Demonstrating the ability to manage various types of credit can positively impact your score. Don’t take on debt unnecessarily. Instead, have a mix of different credit types and manage them responsibly.

- Avoid opening too many accounts: While it might be tempting to sign up for more credit opportunities, having too many new credit accounts in a short period can decrease your score. Each application results in a hard inquiry and can shorten your average credit history.

- Monitor credit reports regularly: Regularly checking your credit reports from the three major bureaus can help you spot errors or fraudulent activities. If you identify inaccuracies, rectifying them immediately can protect you while boosting your score.

Key Takeaways: What Is a Good Credit Score?

A good credit score indicates reliability and responsibility. Generally, scores that hover around the 700s are considered good, but this can differ based on the scoring model used. Beyond just the numbers, these scores dictate lending terms, influence rental and employment opportunities and can determine insurance premiums.

Having a good credit score also fosters long-term financial stability. One of the ways to enhance and manage your credit health is to explore the benefits of a credit union. We recognize the significance of strong credit and offer resources, financial counseling, tools and lending options tailored to your unique needs. Contact us today to learn more about our loan and credit offerings.